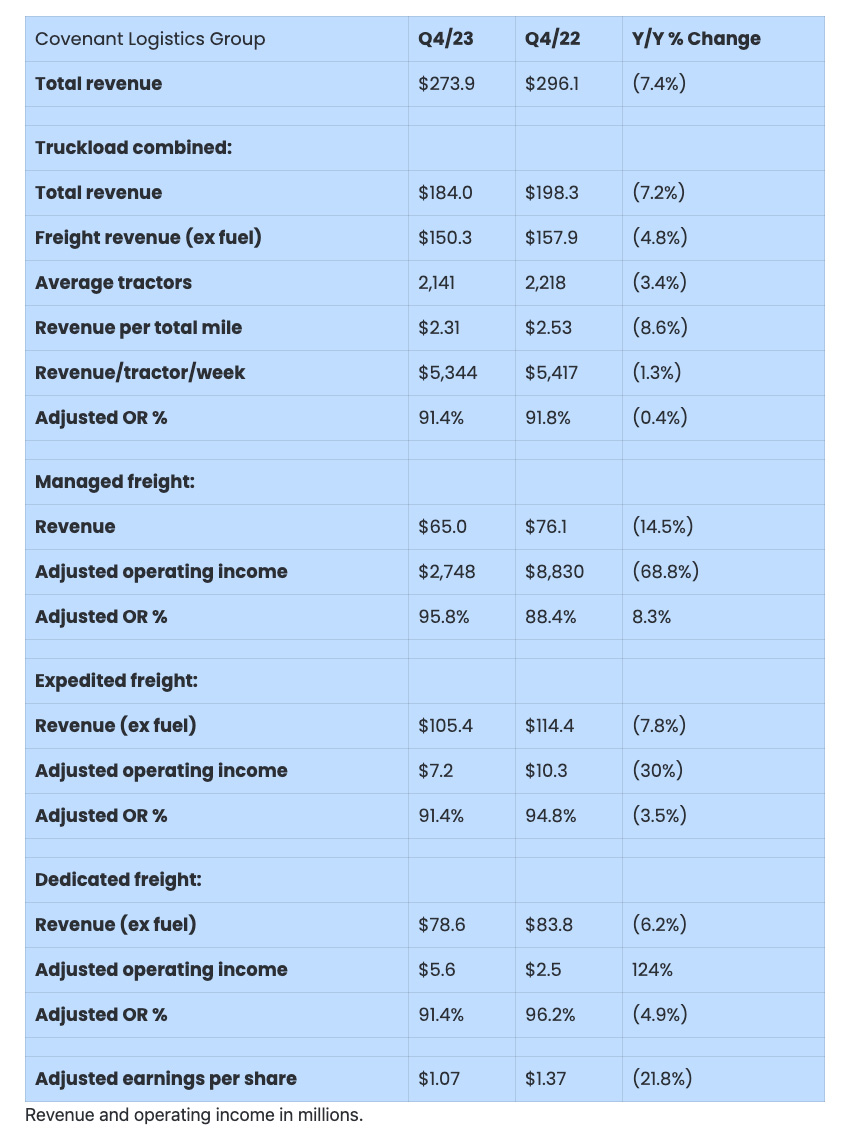

Covenant Logistics Group (NASDAQ: CVLG) reported adjusted earnings per share of $1.07 for the fourth quarter on Tuesday after the market closed, a 22% year-over-year decline and total revenue in the quarter declining 7.4% year-over-year to $273.9 million.

The carrier cited weaker freight conditions in the truckload market despite strategic planning that yielded positive results, said David Parker, Covenant chairman and CEO, in a Jan. 23 news release announcing the earnings report.

“Despite the challenges that come with a soft freight market, our team found a way to be successful in 2023,” Parker said in a news release. “We achieved our second-best adjusted earnings per diluted share in company history while improving the durability and diversification of our business through our acquisitions of Lew Thompson and Son Trucking Inc. and Sims Transport Services.”

Chattanooga, Tenn.-based Covenant’s fourth-quarter earnings-per-share and revenue beat Wall Street predictions of $1.03 and $214.5 million, respectively.

The transportation services provider posted total freight revenue of $240 million during the quarter, a 6% year-over-year decrease from the same period last year. Combined truckload revenue was $184 million in the fourth quarter, a 7% year-over-year decline.

- The company operates four business segments: expedited, dedicated, warehousing and managed freight transportation.

- Freight revenue per tractor per week decreased 8% year-over-year to $5,344 during the fourth quarter.

- Revenue in the expedited truckload segment decreased 6.5% y/y to $84.4 million, and dedicated segment revenue dipped 6% year-over-year to $78.6 million.

- Covenant’s managed freight segment saw revenue of $65 million in the fourth quarter, a decrease of 14.5% from the same time last year. The warehousing segment had revenue of $24.6 million during the quarter, a 16% year-over-year increase.

Parker said the company does not anticipate the freight market to recover in the short term.

“As we look to 2024, we do not see anything in the first half of the year that would indicate a near-term recovery of the freight market,” Parker said. “In the first quarter, we expect our revenue and earnings to decline, reflecting normal seasonality and the temporary headwinds of severe inclement weather conditions, year-over-year rate reductions in our expedited segment, and incremental costs associated with a large new customer startup within our dedicated segment.”

For more information, visit covenantlogistics.com.

Report Abusive Comment