The start of 2024 bodes well for domestic and Canadian asphalt shingles as well as modified bitumen when compared to the end of 2023, according to the latest Asphalt Roofing Manufacturers Association report.

ARMA’s Q1 2024 Quarterly Product Shipment Report shows shipments of U.S. shingles increased between the fourth quarter of last year and Q1 of this year. This continues a trend seen since the reports began in 2017. Though not the largest Q1 increase seen in the report’s history (24.9% from 2018 to 2019), it was a respectable 14.8% jump.

Canadian shingle shipments grew by 81.6% between the two latest quarters. Like its U.S. counterparts, an increase from Q4 to Q1 in this category has occurred since ARMA’s first reports. While impressive, this year's uptick in shipments isn't nearly as strong as the 217% surge experienced in Q4 2018 to Q1 2019.

Modified bitumen product shipments jumped up by 20.7% from Q4 2023 to Q1 2024, which is the largest quarter-to-quarter increase in the report’s history for Q4 to Q1.

BUR base, ply, and mineral cap sheets experienced a decrease when comparing quarter to quarter, dropping by 15.6%. This is the largest Q4 to Q1 decrease for the product category.

Q1 Year-to-Year: Highs and Lows

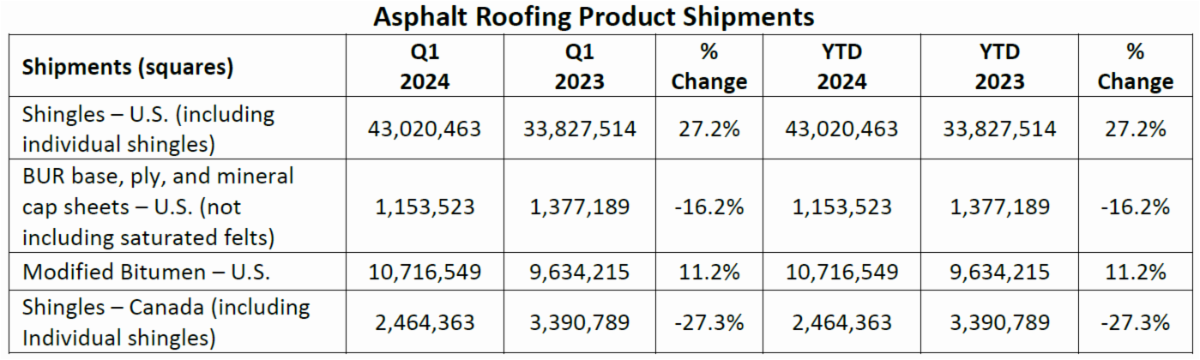

Comparing Q1 2024 to the same time last year tells a similar story of record numbers. U.S. shingles saw a bump by just over a quarter (27.2%), but shipments of Canadian shingles are down by a nearly the same amount (27.3%).

The difference between U.S. and Canadian shipments becomes starker when examining past data. The total shipments for U.S. shingles in Q1 2024 was tracked at 42 million squares, the second-highest total in the report’s history for the first quarter. Meanwhile, Canadian shipments saw its lowest amount of Q1 shipments ever at 2.4 million squares.

Modified bitumen is up by just over 11% from last year. This resulted in the highest Q1 volume of mod bit shipments in the ARMA report’s history, clocking in at 10.7 million squares.

Conversely, BUR product shipments took a 27.3% hit. As a result, BUR had its worst first quarter, seeing only 1.2 million squares shipped.

Roofing product shipment data is collected from participating manufacturers by an independent third party, Association Research Inc., and aggregated to create ARMA’s reports.

Economic Forecasts

The numbers seem to indicate a strong, if bumpy, start to the year. However, rising supply chain issues, a presidential election and other factors may affect where the rest of the year heads.

Construction input prices increased 0.4% in March compared to the previous month, according to U.S. Bureau of Labor Statistics data analyzed by Associated Builders and Contractors. Both overall and nonresidential construction input prices are 1.7% higher than a year ago in March.

“There has been growing evidence of resurfacing inflationary pressures in the nation’s nonresidential construction segment during the past two months,” said ABC Chief Economist Anirban Basu. “Were it not for declines in energy prices, the headline figure for construction input price dynamics would have been meaningfully higher.”

Basu warns, however, that a new set of supply chain issues are emerging, which includes the costs of insuring ships and bottlenecks in the Red Sea, the Panama Canal, and Baltimore.

“With continuing wage pressures and elevated borrowing costs, the implication is that financing construction projects will remain expensive relative to historic norms for the foreseeable future,” Basu said.

The job market recently experienced a major boost that could help bolster the roofing industry. In March, the construction industry added 39,000 jobs on net, a 3.4% increase compared to the same time last year, according to BLS data. Nonresidential construction employment increased by 24,600 positions on net, with nonresidential specialty trade adding the most jobs, increasing by 16,300.

The construction unemployment rate fell to 5.4% in March, while overall, unemployment ticked down from 3.9% to 3.8% when compared to February. The encouraging numbers suggest a recession isn’t about to slam the country anytime soon.

“Despite the effects of worker shortages, still-elevated materials prices, newly emerging supply chain issues and the high cost of project financing, both privately and publicly financed segments produced substantial employment growth in March,” Basu said.

Report Abusive Comment