Shipments of various asphalt roofing products followed the years-long trend of slowing down in the third quarter, though a particular product saw an all-time high in volume when compared to previous third quarters.

The Q3 2023 Quarterly Product Shipment Report from the Asphalt Roofing Manufacturers Association [ARMA] revealed the amount of shipments for shingles, BUR and modified bitumen dropped in the third quarter. Like the previous two years, shipments decreased compared to a strong Q2 showing, with most of the decreases in the double-digit percentages.

When comparing Q3 2023 to Q2 2023, the following data emerges (reported in squares):

- U.S. Shingles: 46 million, down 11.6%

- BUR Base, Ply and Mineral Sheet Caps: 1.5 million, down 17.5%

- Modified Bitumen: 11 million, down 5.6%

- Canada Shingles: 1.9 million, down 20.8%

The decreases are relatively close to what the asphalt industry experienced this time last year, indicating supply chain issues influenced by material price increases, inflation, labor, and new and on-going conflicts across the globe may not have returned to pre-pandemic levels.

“When inflation began to emerge in 2021, supply chains ill-prepared to handle surging demand for goods and services during the early stages of post-pandemic recovery were among the primary culprits,” said Associated Builders and Contractors Chief Economist Anirban Basu in a written statement. “Today, inflation is driven less by supply chain issues and more by structural labor market dynamics and geopolitics.”

“Many contractors continue to indicate that their primary challenge is securing sufficient levels of workers. That will not change anytime soon and could only be countered by a sharp downturn in construction activity.”

Reports from the pre-pandemic year of 2019 show from Q2 to Q3 2019, U.S. shingles were down 13.4%, BUR down by 2.9%, mod bit down by 0.9%, and Canadian shingles by 21.6%. In 2018, though, all shipments were down by single-digit decreases with the exception of mod bit.

Since ARMA’s first report in 2018, the only year to buck the trend of all shipments decreasing in the third quarter is 2020. That quarter-to-quarter comparison saw increases in U.S. and Canadian shingle shipments, likely caused by people working from home due to pandemic-related restrictions and wanting to make improvements.

There is a sliver of hope in the data. In terms of sheer volume, Q3 2023 saw a record number of mod bit shipments when compared to previous third-quarter shipments. The number of mod bit shipments was reported at 11 million.

The same can’t be said for the remaining products, most notably Canadian shingles, which had its worst third quarter in 2023.

Year-to-Year: A Mixed Bag

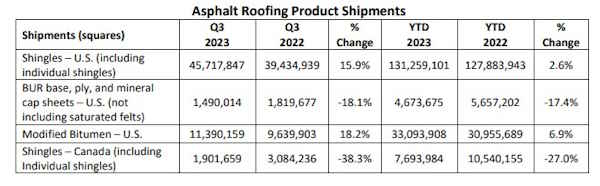

According to ARMA’s data, comparing Q3 2023 to the same time last year shows good and bad news in regards to shipments.

- U.S. Shingles: Up 15.9%

- BUR Base, Ply and Mineral Sheet Caps: Down 18.1%

- Modified Bitumen: Up 18.2%

- Canada Shingles: Down 38.3%

This year-to-year comparison is slightly better than what the asphalt industry saw in Q3 2020 to 2021, where all four product categories fell in shipments.

ARMA also calculates the year-to-date totals in its reports, showing the overall number of shipments made as of the end of Q3 2023. With the exception of mod bit, which is 1.8% higher, all year-to-date shipment totals are down when comparing 2022 and 2023 (see the chart above).

Overall, 2023’s year-to-date totals are a mix of record highs and lows. BUR’s totals are the lowest in the report’s Q3 history at 4.6 million, as are Canadian shingles at 7.6 million, but mod bit is at its highest year-to-date Q3 total. If the numbers continue as they have, 2023 might be the lowest shipping amounts for BUR and Canadian shingles in the history of the reports.

Year-to-date U.S. shingle shipments have fared better than last year’s totals, up by 2.6%, while mod bit is up by 6.9%.

Report Abusive Comment