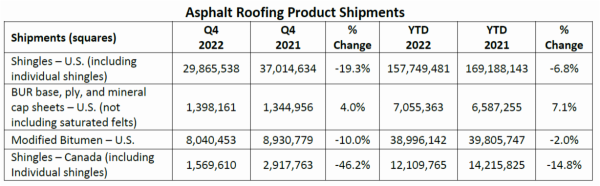

Across the board, every category in the asphalt roofing product line experienced massive declines in shipments during the final quarter of 2022, revealing the true impact of the supply shortage on roofing, according to the Asphalt Roofing Manufacturers Association.

In ARMA’s final 2022 Quarterly Product Shipment Report, quarter-over-quarter comparisons show each tracked category dropped by more than 10%, and in some cases nearly by half. The Q4 numbers, contrasted by the preceding quarter, and reported in squares, include:

- U.S. Shingles: 2.9 million, down by 24%

- Built Up Roof (BUR): 1.3 million, down by 23%

- Mod Bit: 8 million, down by 16%

- Canada Shingles: 1.5 million, down by 49%

The supply shortage, which emerged during the COVID-19 pandemic, seemed to worsen in 2022, as reflected by our sister publication, Roofing Contractor’s 2023 “State of the Industry” survey. In the ´21 survey, 23% of contractors said supply shortages had “little to no impact” on their business. In the most recent survey, that number shrank to just 5%.

Industry experts note that shipments typically slow down in the fourth quarter, in part due to cold weather hindering roofing work. However, last year’s declines far outpaced what was seen in 2021, where U.S. shingles shipments dropped by 11.9%; Canadian shingle shipments by 12.4%; and U.S. modified bitumen shipments, and BUR, by 17.8% and 17.7%, respectively.

One bright spot in the 2022 survey showed BUR did make a modest year-over-year gain, but it was the outlier. Every other product saw decreases ranging from 10% to 46%.

Comparing overall year-over-year shipments from 2021-2022, most arrows pointed in the wrong direction as indicated by the numbers below.

- U.S. Shingles: Down by 6.8%

- BUR: Up by 7.1%

- Mod Bit: Down by 2%

- Canada Shingles: Down by 14.8%

Some industry watchers have noted how increased costs across the board for roofing material may be a contributing factor to the declines. Inflation, combined with the current shortages, have caused prices to spike over the past year. Data from the Bureau of Labor Statistics shows construction input prices fell 2.7% in December compared to the previous month, though they are still 7.9% higher than they were a year ago.

These latest price point developments are both good and bad news, says Associated Builders and Contractors Chief Economist, Anirban Basu, noting with a hint of optimism that, behind the statistics, lies good news on inflationary pressure.

“Recent consumer and producer price releases indicate that inflation is fading, though it remains well above the Federal Reserve’s 2% target,” said Basu in a written statement. “Should inflation continue to abate, the Federal Reserve may be able to stop increasing interest rates sooner than anticipated. Interest rate-sensitive segments like real estate and construction would be among the primary beneficiaries.”

Report Abusive Comment