Saint-Gobain, the French construction materials group, reported a 6.4% fall in annual sales last week, as strong currency effects and weak volumes weighed on its 2023 annual results, during its 2023 fourth-quarter earnings call with reporters last Thursday.

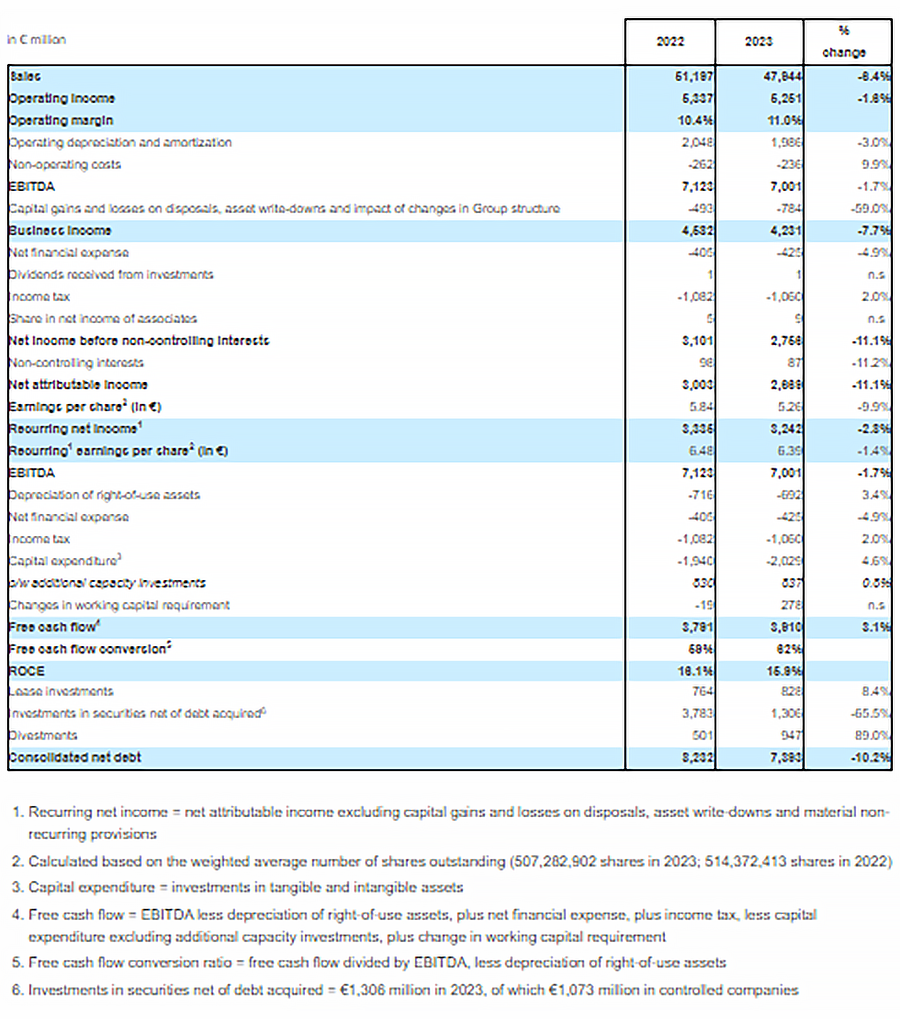

The company posted annual sales of €47.94 billion ($51.77 billion), compared with €51.2 billion in 2022. In a company-provided poll, Reuters reported that analysts expected sales to drop 6.1% to €48.08 billion.

In 2023, sales volumes were down 5.5%, a more significant drop than expected. Stifel Financial, a brokerage firm, said it had expected a 4.9% fall in 2023 volumes.

The company acknowledged its performance was also hit by a slowdown in business across Northern Europe, which represented 26% of its 2023 sales; sales in that region were down 5.9% in 2023, with a "sharp slowdown in new construction," the company said in the Feb. 29 earnings call.

"In Western Europe, renovation will continue to show resilience, while new construction will remain difficult but will gradually reach a low point country by country, in a market that remains structurally healthy given its construction needs," CEO Benoit Bazin said in a statement.

The construction materials maker, which has aggressively established a beachhead in North America with acquisitions including CertainTeed, Solar Gard and Building Products of Canada, said that while expects the overall market to remain challenging in 2024 — particularly in the first half of the year — North remains a bright spot; the company stills believes it can achieve a double-digit operating margin in 2024.

Americas: Sales Growth and Record Margin

Saint-Gobain reported that as a region, the Americas delivered 1.9% organic growth in 2023, driven by the outperformance in North America. Operating income of €1.6 billion hit a new record high, and margins increased by .07 percent YoY to 16.8 percent thanks to volume increases in North America.

North America reported 5.3% organic growth over the year — 8.7% as reported, including the integration of Kaycan, Building Products of Canada and GCP’s waterproofing membranes — in a stabilized construction market. Capital expenditure in North America totaled more than €350 million in 2023.

Latin America was down overall by 7.3% in 2023 despite market share gains in Mexico and what the company described as a “highly successful integration” of Impac, a construction chemicals and waterproofing company.

Year-End and Dividend Returns

EBITDA came in at €7,001 million, and recurring net income was €3,242 million; the tax rate on recurring net income was 25%. Capital expenditure totaled €2,029 million, and ROCE was 15.9% in 2023, resulting in strong value creation for shareholders. Net debt fell 10.2% to €7.4 billion.

Saint-Gobain’s Board of Directors said it will recommend to shareholders a cash dividend payment of up to 5 percent, or €2.10 per share, for 2023. The ex-dividend date has been set at June 10, and the dividend will be paid on June 12, 2024.

Report Abusive Comment