As many roofing distributors will attest, knowing your customers' needs and what they are going through offers an advantage over the competition, and can also improve both strategy and operations.

With that in mind, we looked at survey results from Roofing Contractor’s 2023 State of the Industry Report to offer insight into your clients’ challenges and how they’re dealing with them.

Roofing Contractor sends out an annual survey to its subscribers asking what issues are affecting contractors in both the commercial and residential markets. Below are some findings distributors should consider this year and beyond.

Supply Shortages

It’s no secret supply shortages are generally hindering the roofing industry, but supply procurement featured prominently in RC’s latest survey and was cited just below material costs as contractors’ primary struggle. Overall, the top challenges noted by roofing contractors in 2022 include: material costs (55%), supply chain/material shortages (51%), current economy/inflation (47%), and a lack of qualified workers (42%).

Specifically, respondents listed increasing costs (81%), project delays (73%), and hard-to-get materials (71%) as the biggest issues facing them during the past year.

When broken down further, 61% of commercial roofing contractors listed “supply chain and material shortages” as their top challenge, while 48% of residential contractors reported the same top finding.

Concerns over product quality have also reared this year, which at 13% of respondents may not sound significant, but compared to results from last year when no participating contractor listed this as a challenge, it should be considered a red flag.

Delays and Demands

New to this year’s survey was a section focusing on the supply chain. One question asked whether contractors switched manufacturers in the past 12 months. More than half of respondents, 57%, said they had, in fact, switched distributors, citing “availability of products” as the principal reason. Examples of comments recorded in the survey included: “[H]ave to go with products that are available,” “Lead time was too far out,” and, most importantly, “…the supplier had the material we needed to do the job.”

Aside from availability, contractors that did switch were also looking for cost savings. “Cost” was listed as the second biggest reason for changing distributors. This was followed by “customer service,” underscoring the value that comes with maintaining established relationships with manufacturers. The takeaway: customer service and relationship maintenance can score you jobs when contractors are seeking help.

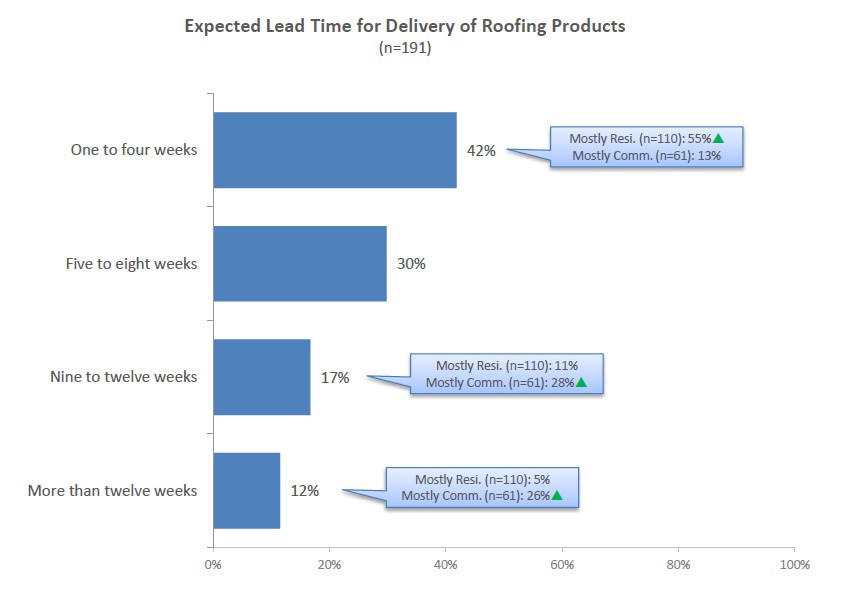

More than one-quarter of respondents reported their expected lead times for roofing products to be nine or more weeks for delivery. This is mainly driven by commercial contractors. Meanwhile, 42% of contractors anticipate delivery times to be one to four weeks.

Product Preferences

Not surprisingly, steep-slope asphalt shingle roofing systems were listed as the most used product for residential contractors, with 83% listing it as their primary product; that figure is an increase of 6% from the year prior.

Residential contractors say laminate shingles are the top steep-slope asphalt product in sales, followed by wind or hail-resistant shingles, three-tab shingles and super heavyweight shingles. Of note is an uptick in contractors selling hail- or wind-resistant shingles compared to a year earlier – most likely a reflection of increases in severe weather systems.

On the commercial side, 85% of commercial contractors say single-ply is their top product category, which is a slight decrease of 5% from last year.

In the most sold product category for single-ply, TPO comes out on top in terms of sales, followed by EPDM, PVC and KEE. TPO sales increased slightly by 2% compared to last year, with 49% of respondents citing it as their top procurement. EPDM sales decreased year-over-year, going from 32% to 26%.

For both markets, metal roofing is the second most popular product at 81% and 82%, respectively. These are modestly higher by a couple of percentage points over last year’s results, suggesting an increase of on-hand metal stock is worth consideration, if you haven’t done so already.

When broken down by specific products, architectural standing seam is the most popular metal system, with 38% of respondents on both sides of the industry, citing it as the preferred system. Roof edge and gutter systems are next, comprising 21% of residential metal sales and 34% of commercial metal sales. These are followed by structural standing seam at 19%, and metal architectural products like shingles and tiles at 15%.

Emerging Trends

After asphalt shingles and metal, single-ply roofing at 73%, low-slope asphalt at 59%, and coatings at 57% round out the top five products for residential roofing market.

For commercial sales, the remaining top five are coatings at 66%, low-slope asphalt at 64% and steep-slope asphalt shingles at 44%.

An interesting detail emerging from the survey results relates to coatings. Though overall sales remained small at 8% of overall sales, the number of commercial roofing contractors citing the use of coatings exceeded 60% — surpassing both low-slope and steep-slope asphalt for the first time in the survey’s history.

Looking toward this year’s anticipated sales, residential contractors expect the largest increase in sales to be equally in steep-slope asphalt shingles and metal roofing at 63%, followed by solar at 56%. For commercial roofing, contractors expect metal sales to rise out of all other product types at 62%, followed by single-ply roofing at 57%, and coatings at 52%.

Contractors are also looking for companies that will supply them with safety equipment. Nearly three out of four respondents say they provide all safety equipment to their workers. When split between residential and commercial, 66% of contractors identifying as “mostly residential” provide their own equipment. For mostly commercial contractors, 85% provide all safety equipment.

Report Abusive Comment